The tax liabilities calculation from Budget 2023 has caused lots of confusion among the taxpayers regarding new tax scheme and old tax scheme.

The government has introduced lots of tax incentives in the budget 2023, so, the tax payers in adoption of new tax regime.

The following are the main difference between old tax regime and New Tax regime

| Income Slab | Old Tax Regime | New Tax Regime until 31st Mar 2023 | New Tax Regime from 1st Apr 2023 |

| Rs 0 – Rs 250000 | Nil | Nil | Nil |

| Rs 250000 – Rs 300000 | 5 % | 5 % | Nil |

| Rs 300000- Rs 500000 | 5 % | 5 % | Nil |

| Rs 500000 – Rs 600000 | 20 % | 10 % | 5 % |

| Rs 600000 – Rs 750000 | 20 % | 10 % | 10 % |

| Rs 750000 – Rs 900000 | 20 % | 15 % | 10 % |

| Rs 900000 – Rs 1000000 | 20 % | 15 % | 15 % |

| Rs 1000000 – Rs 1200000 | 30 % | 20 % | 15 % |

| Rs 1200000 – Rs 1250000 | 30 % | 20 % | 20 % |

| Rs 1250000 – Rs 1500000 | 30 % | 25 % | 20 % |

| > Rs 1500000 | 30 % | 30 % | 30 % |

Standard deduction and family pension deduction:

Salary Income: The standard deduction of Rs 50000, which was only available under the old scheme, has now been extended to the new tax scheme as well.

In addition the rebate mark of Rs 750000 as your tax free income under the new tax scheme.

Family Pension:

Family pension can be claimed of Rs 15000 or 1/3 of pension whichever is less.

Reduced Surcharge for High Net Worth Individuals:

The income above 5 crores has been reduced from 37 % to 25 % so, this brings down the effective rate of tax 42.74 % to 39 %

Default Regime: Starting from FY 2023-24 the new tax scheme will be set as default option so, if you want to old scheme need to file a form during filing return.

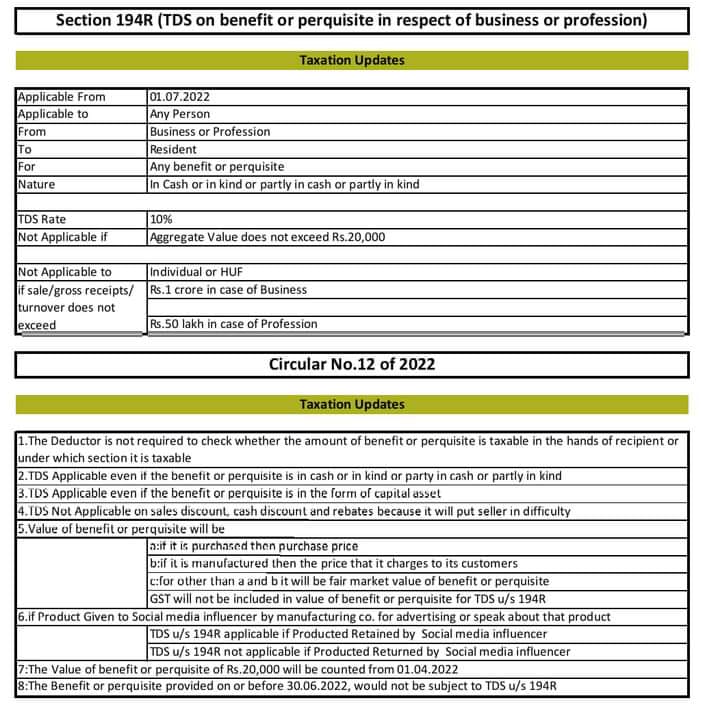

Also Read: Section 194R TDS: Applicability as per Income Tax Act

Download the Utility for Determining Materiality in Excel Sheet